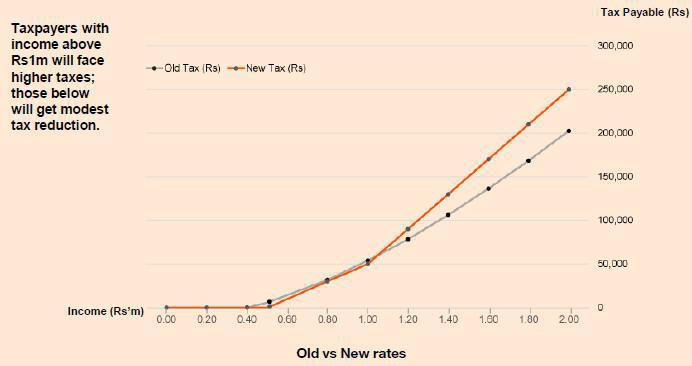

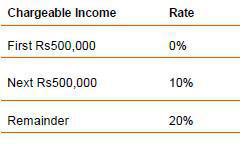

Revised personal tax rates

Effective from 1 July 2025, the tax rates will be revised as follows:

Income support

Effective from September 2025, an income support of Rs10,000 will be introduced to eligible personsabove 60 years old but not having attained pension age.

Review of Personal Reliefs

Effective 1 July 2025, the following reliefs will be repealed:

- deduction for household employees;

- relief for adoption of animals; and

- angel investor allowance.

Fair-Share Contribution on high-income earners

Effective for the income year commencing on 1 July 2025 and for the two subsequent income years, an individual whose net income exceeds Rs12m,inclusive of dividend income from domestic companies and share of dividends in resident sociétés/ successions,will be required to pay a Fair-Share Contribution at the rate of 15% on theamount in excess of Rs12m.

The following will be excluded for the purpose of determining the leviable income:

- Dividends and distributions received from a global business entity; and

- Any lump sum by way of commutation of pension or by way of death gratuity or as consolidated compensation for death or injury and paid:

- By virtue of any enactment;

- From a superannuation fund; and

- Under a personal pension scheme approved by the Director-General.